While the world circumstance was flaky, 2020 wound up ending up being Bitcoin’s year. Regardless of fumbling in March, it has actually considering that recuperated to reach brand-new extraordinary all-time-highs ($37,152 at press time).

Restored Confidence in Bitcoin

With restored self-confidence in Bitcoin, we are seeing mass-media detecting the cost action by composing, and streaming about BTC throughout all the significant news outlets yet once again. In volumes that we have actually not seen considering that BTC reached $20,000 in 2017. A cost that has not yet even been checked as assistance.

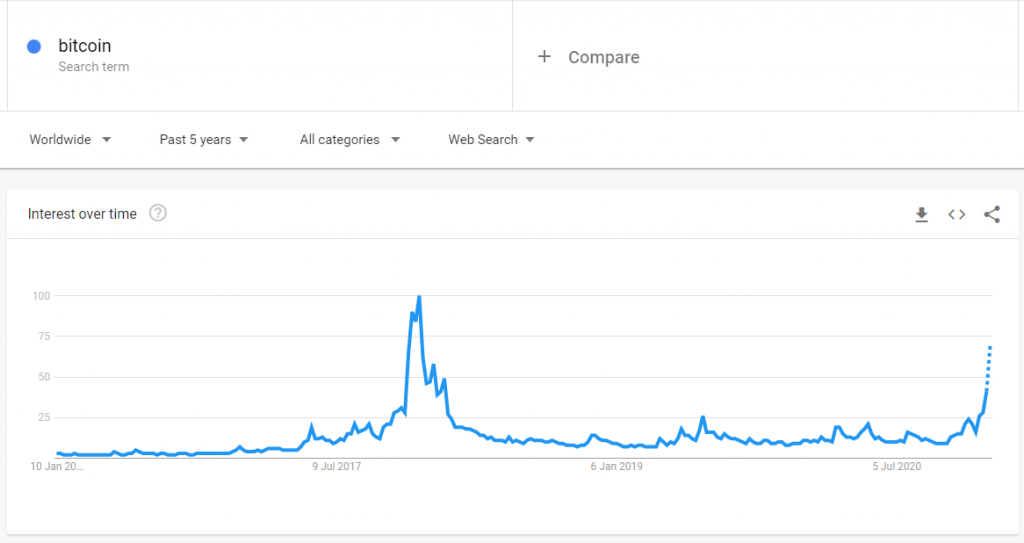

Google pattern verifies that too. As interest in Bitcoin has actually been getting quickly just recently. The chart plainly suggests that there is still space for Bitcoin to reach the very same interest levels we saw throughout its last huge parabolic increase. This might show that there is still space for development for bitcoin, prior to an inescapable correction.

Bitcoin Price Action Controlled by Large Institutional Investors

The majority of the cost action of Bitcoin was supported by a huge buy-up of BTC by institutional financiers obtaining abstruse amounts of Bitcoin. In December alone, Grayscale purchased 3 times the quantity of Bitcoin that was mined, far surpassing the produced supply (72,950 BTC) Thereby considerably managing and skewing the need and supply in their favor. Technically, the longer they have the ability to continue this pattern, the longer they are can handle and lead the bitcoin bull run too. The more limited they can make Bitcoin, the much faster it will grow and the more steady the cost action might ultimately end up being.

JPMorgan Forecasts Bitcoin to reach $146,000

Bloomberg just recently reported that JPMorgan has a rate target of $146,000 per BTC. As they see Bitcoin’s prospective to equivalent to the economic sector financial investment of gold. JPMorgan kept in mind, nevertheless, that this is a “multiyear procedure”, and “hence an unsustainable rate target for this [2021] year.”, mentioning increased interest from millennials to select Bitcoin over Gold.

Bitcoin Marketcap to Equal Gold’s

JPMorgan is not alone in setting high cost targets for Bitcoin, with numerous other financial investment companies and traders believing around the exact same lines. Skybridge see Bitcoin striking $100,000 by the end of 2021, while possibly long term seeing a price of $535,000 per coin. This would equate to the bitcoin market cap to that of gold.

Gold presently has a market cap of around $10 trillion, while the whole cryptocurrency market cap simply reached $1 trillion for the very first time in history. Bitcoin’s market cap is simply under $700 million presently and for that reason has prospective for development if it is to reach the exact same assessment as gold’s whole market.

Now it is still anybody’s guess as to what will take place to Bitcoin’s rate in the near future, however long term numerous concur that Bitcoin’s potential customers are looking really appealing.

The post Is Bitcoin going to $535,000? Skybridge Thinks So appeared very first on Bitcoincasinolord.